Photo: Getty Images by Richard Drury

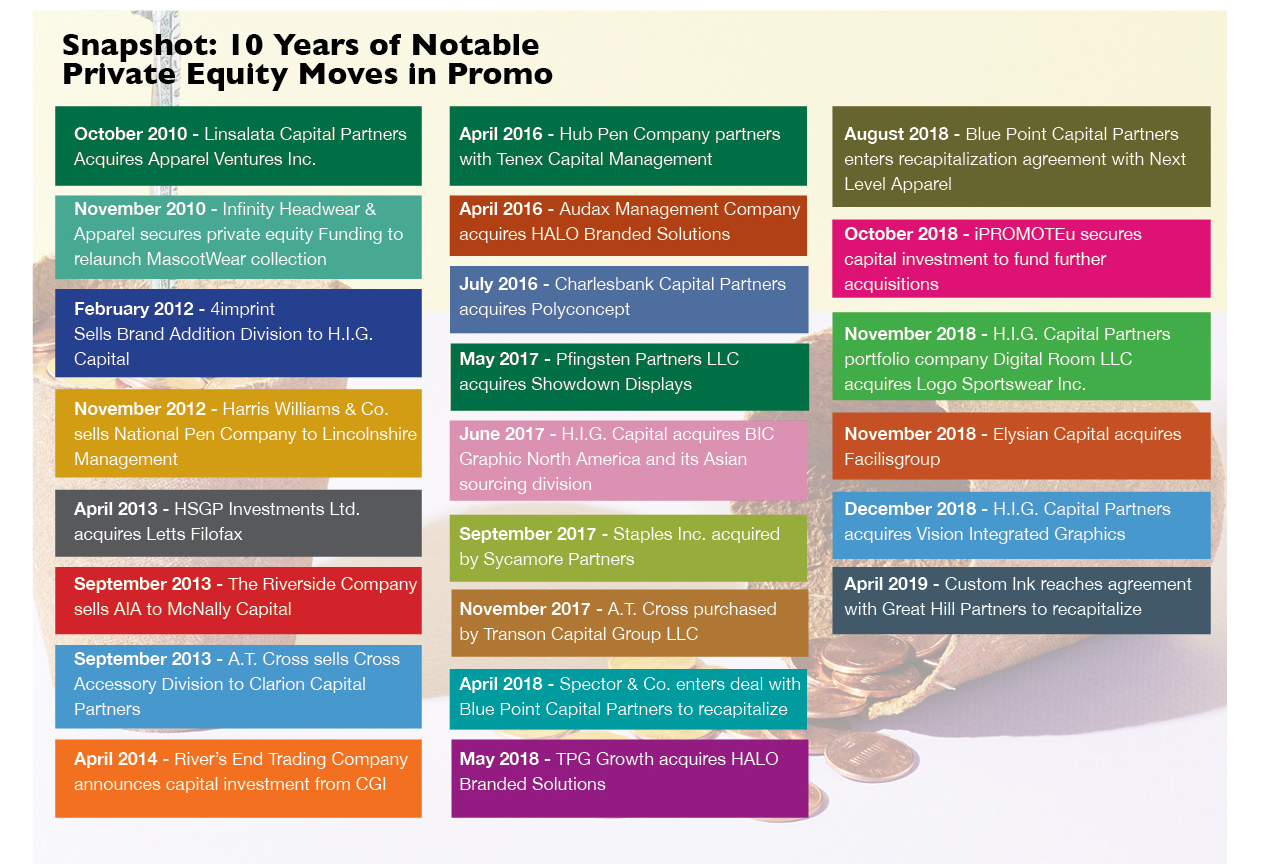

Private equity's continued and, seemingly, increasing involvement in the promotional products industry has led to major growth for some companies and uncertainty for others. With private equity a fact of life for promo, we take a look at the pros, cons and gray areas for the industry.

Share Article

by Brendan Menapace

March 2020

If you think about private equity involvement in the promo industry, your train of thought likely goes in one of two directions. Those with some sort of connection to it probably think about how their business has been more successful after partnering with a private equity firm. Maybe they were able to make more investments in their manufacturing and shipping capabilities. Maybe they were able to buy more property or upgrade existing facilities. Maybe they were even willing to purchase other companies to become a more powerful competitor in a growing industry. For those people, their association with private equity is largely positive.

On the other side of the private equity Rorschach test, some people will think of those old movies where the ski resort is purchased by some anonymously evil investor, the staff is fired, and the resort is sold to another highest bidder, bereft of the personality that had made it famous to start. Or, they think of popular publishing companies of the 2010s—the online publications that survived the “pivot to video” war and came out with a dedicated audience, only to be swallowed up by some corporate entity that promises no changes but goes back on those agreements almost immediately, spitting out a shell of the once-viable company, if there’s anything left at all.

To bring it back to the promotional products space, private equity is still a polarizing matter. With ongoing concerns about over-consolidation in the industry creating a powerful few companies on another tier than smaller independent ones, private equity can be seen as a danger. You can look no further than the problems Staples Inc. faced after being purchased by Sycamore Partners.

Staples finalized its $6.9 billion sale to Sycamore Partners in September 2017. In the span of just over two years, Staples parted ways with its CEO after a failed merger with Office Depot, laid off hundreds of employees, rebranded itself as a “worklife” company rather than an office supplies company, faced reports that Sycamore was already looking for ways out of its investment, named a new head of its promotional products division, laid off a couple hundred more employees, got into some legal hot water over Sycamore’s purchase of Essendant (another office supplies company) and resolved a court battle over the merger.

Staples is a bit more unique in its misfortune, and its bumpy start with Sycamore Partners shows that size alone isn’t enough to protect a company from trouble with private equity. Others, especially in the promotional products industry—Next Level Apparel, Hub Promotional Group and SnugZ USA, to name a few—consider themselves success stories, shining examples of what an injection of private equity funding can do for a business. They are companies that have reaped the benefits of greater financial stability and resources without having to compromise their identity, brand reputation or the livelihoods of their employees.

Still, the issue of private equity is polarizing, and no two experiences are alike. There are still vocal critics of the dangers private equity poses to businesses and the industry, like Phil Koosed, president of BAMKO, who we’ll get to in a bit.

The unique nature of every private equity acquisition makes it far from a black and white issue. For every rule, there is an exception. But there’s no denying that it’s a debate the promotional products industry should be having with itself. As private equity investment and consolidation change the competitive landscape, companies will at some point have to decide which side of the issue they’re on.

THE GOOD

Hub Promotional Group, Braintree, Mass., is perhaps one of the best examples of how private equity money can help a company expand and grow significantly. After acquiring seven companies within the last two years—including Debco, Handstands, BCG Creations and Origaudio—adding a whole slew of employees to its staff, and rebranding for the first time in 65 years (to HPG), Hub has positioned itself as a major player in the market. The company’s CEO, Chris Anderson, attributes a lot of that success to private equity funding.

“We are an amalgamation that started with one business, Hub Pen, nearly 70 years ago based in Boston, that had an expert ability to produce and ship writing instruments with the speed, quality and value proposition that was highly compelling for our end-users and distributor partners,” Anderson said. “And yet, you think about that, and not every event calls for a writing instrument, and we want to serve as many constituents in the promo market as possible. So the question is, simply, ‘What do we do to take some of these best practices at Hub Pen—and Hub Pen for years has been renowned for its customer service, for its efficient production, for its short lead times and high quality products—what can we do to take all of that and expand it to other categories within the marketplace? And what I have found is that, unlike other product-based categories or industries, the promo market has been very enthusiastic in taking what it has come to know and love in a business like Hub Pen, and seeing those same attributes within sister companies and seeing some of those best practices shared.”

Anderson said that strategic acquisitions allowed Hub to add more personalities and brand identities to the company in addition to just the product categories it specializes in. He specifically cites the acquisition of Origaudio. “You can have an entrepreneurial company like Origaudio, another one of our portfolio companies within Hub Promotional Group, that it was in essence a ‘Shark Tank’-type proposition as it started,” he said. “And it turned into one of the most innovative and dynamic companies in the promo tech space. And yet, in terms of infrastructure, in terms of capabilities, it was still several decades behind Hub. And so by marrying up the innovation and the disruption of Origaudio with the strength—with the decades of understanding of what it takes to delight a promotional customer—that’s been a scenario of ‘1 and 1 equals 3.’ And that essentially is the right type of acquisition and consolidation in the promo industry. If you start with architecture that we’re going to broaden our reach within a very defined product category or sets of product categories, and we’re going to do so in such a way that the end-user benefits, that’s when consolidation is the right thing for an industry. And in promo, there’s plenty of room for that type of consolidation.”

Simply put, private equity investment that leads to consolidation is a good thing in a vacuum, at least for distributors and end-buyers. When you have a supplier that wants to give customers every conceivable product they could want, coupled with extensive industry experience in fulfilling orders and customer service, it’s hard to argue against it. And, in that same scenario, a company like Origaudio might have had a lower ceiling than it does now with more financial backing, and the benefit of sharing knowledge and resources with a 70-year-old industry company.

That’s been at the heart of Next Level Apparel, too. What started as something of a mom-and-pop operation until 2019 grew substantially when Blue Point Capital purchased a portion of Next Level. The small-business identity was still there, as was original founder Joe Simsolo, but in came more employees with specialized positions to handle greater demand and capabilities. One of those people was Amanda Mitzman, who signed on as Next Level’s marketing director.

“It’s been a really unique experience having all of these fresh perspectives working together to build this new Next Level,” she said. “The other initiative was to refresh the brand, really work on creating who we are, our mission statement, what our goal is, and just being transparent with our customers, which is really what Next Level is all about—transparency, inclusivity. We try to treat all of our relationships like they’re family. It’s great having Joe, who was the single owner, as a part of this company still. We do still have a lot of those initial family values in the company, but also the backing of Blue Point Capital. It’s this amazing balance between the two, where you feel the close-knit community here, but also know that opportunities are endless.”

This seems to be the most common reason companies proactively seek out private equity partners. If you want to do more in the industry or maybe bring on a few more brands within your portfolio to reach more potential customers, but it’s beyond the financial confines of your business, you seek out investment. The question for others who might be skeptical about private equity involvement and consolidation is: What does it mean for small or medium-sized independent companies who don’t want to be beholden to outside ownership?

“I definitely think [competing] is more of a challenge,” Mitzman added. “With Blue Point coming in, they really have a full team of people whose sole responsibility is really evaluating the companies. And if you don’t have those eyes, and those outside eyes and perspectives, sometimes the mission and what it takes to get there can get lost. So, I definitely think it’s more of a challenge if you don’t have that backing and that relationship with a private equity.”

“Certainly private equity is a catalyst for growth,” Anderson said. “If you’re in an environment where it’s a fast-growing environment that’s going to require major investments in order to fund the working capital and infrastructural needs of the business, unless you have some other source of liquidity, it’s going to be very difficult to compete against a competitor who has that type of liquidity in the form of a private equity sponsor. That’s not to say that it’s impossible, but nonetheless, having gone down this path a couple of times now, what I can tell you is that in the case of HPG, for instance, we have over the last year invested millions of dollars, many millions of dollars, on real estate. And that real estate investment is something that each one of the businesses that we have invested that real estate for were owned by very sharp and capable founders prior to being part of HPG. And in each case, they have come up to me afterward and said, ‘This is why we did the deal. That was a step too far. That was a bit more than we could have undertaken on our own.’”

"If you pick a private equity sponsor who’s familiar with your class of trade, you can spend more time talking about the actual business and less time bringing them up to speed on what it is to be in this industry in the first place. That’s one of those key mistakes when picking private equity sponsors—that you take the first opportunity that comes your way, and in the end live to regret it when you’re unable to focus on the good of the business and instead are focusing on everything but it."

—Chris Anderson, CEO, HPG

POTENTIAL DOWNSIDES

Still, this is not a black and white issue. It’s far from it. Everyone has their own specific fit, and we’ll get into more of that later. But, for every success story like Hub or Next Level, there are those who remain wary of private equity and its increasingly outsize role in the industry. Koosed is one of those people.

“We spoke with private equity firms prior to our sale to Superior,” Koosed said. “That experience was enough to help us understand that private equity was not the right fit for us. We were only interested in buyers who, [for one] understand our industry, and two, were willing to take a long-term approach to growth and investment. The lifecycle of private equity investments is so short that we were never comfortable or confident that any private equity buyers would be willing to make the sort of long-term investments that we think are increasingly important in this industry. Superior bought BAMKO four years ago, and we are planning for our next 10 years together. Private equity is generally already preparing the business to be flipped again in year four.”

Koosed is quick to point out that private equity companies are not just soulless vampires coming in to deplete a company of its resources and identity, only to flip the husk to some other financial parasite. These are still people, and in a lot of these instances, their end goals match those of the company they are buying. But his concern is the impact on a company’s culture, and that it focuses on “value extraction instead of value creation.” Furthermore, Koosed is firmly on the side of the argument that treading water in the industry as an independent is tougher than it is for those with private equity backing.

“Surviving on your own is definitely harder than it was, because the more well-resourced companies in our space have so much more to offer in a competitive landscape,” he said. “We see a lot of the so-called mom-and-pop shops struggling to provide their sales teams with the tools they need to compete out there. There are a lot of very talented salespeople being sent out there holding a spoon in the middle of a gunfight. If that salesperson is going head-to-head against a company like BAMKO that has a wealth of resources for technology, warehousing, creative, analytics, marketing, overseas and the rest, they find themselves at an incredible competitive disadvantage, which takes a toll over time.”

THE RIGHT FIT

If you’re a company that has considered going the route of private equity, what seems to be the general consensus is finding a partner that is just that—a partner. That is to say, if someone doesn’t seem to know anything about your company even after multiple meetings, they might not be the right fit. But, if after a few meetings you really see eye to eye, share common values and fully understand each other and your intentions, it might be the difference-maker in taking your company to the next level of success.

“I think it’s like anything,” said Brandon Mackey, CEO of SnugZ USA, West Jordan, Utah. “You need to do your homework, and you need to do your own due diligence in making sure that who you’re trying to align yourself [with] has the same ethos as you. I don’t think because they’re private equity they’re bad, or they’re going to blow up a company like in ‘Pretty Woman.’ I think their goal is, of course, to make a profit. There’s no trying to hide that. But I think if you find the right one, it could be beneficial, too. If you’re looking to scale or you’re looking to acquire other businesses—such as SnugZ, SnugZ is out there looking to acquire—then I think they offer a lot of resources that I don’t have. Since they’re in the business-buying field, they just bring a lot of depth and a lot of resources and a lot of expertise that I just don’t have.”

Anderson said that the less time you have to spend filling-in the potential private equity suitors about what it is that you do, the better the chances that they are a good fit. If they have a cursory understanding as is, then they’re not likely to be a company that looks at yours and only sees a piggy bank to flip. “If you pick a private equity sponsor who’s familiar with your class of trade, you can spend more time talking about the actual business and less time bringing them up to speed on what it is to be in this industry in the first place,” he said. “That’s one of those key mistakes when picking private equity sponsors—that you take the first opportunity that comes your way, and in the end live to regret it when you’re unable to focus on the good of the business and instead are focusing on everything but it.”

If a business doesn’t get jumpy and pick the first company that comes its way, it could end up with a lasting relationship that benefits all parties involved and takes the business to new heights. “Blue Point and our board members have been extremely encouraging and inspiring, and it’s just been helping to build up really what’s already existed with Next Level,” Mitzman said. “A lot of these core values were there, but the team was smaller. The team wasn’t as able to be as nimble just because of a smaller size and different priorities, but now we’re really able to work together to really just elevate Next Level and keep those core values, but also create new ones.”

Even Koosed, with his qualms about private equity, isn’t painting with broad strokes. “I think who you work with matters more than most realize,” he said. “Do you have a shared set of values? Are your visions aligned? Are you building something that will stand the test of time, or are you building on a foundation of quicksand that will crumble under your feet in short order? Employers, owners and industry leaders should be asking themselves these questions, and if they’re not satisfied with those answers, they should find people to work with who share their values. Life’s too short not to.”

Private equity isn’t for everyone. Plenty of prominent promo companies have gone without it. And those companies can still compete, as long as they stay ahead of the curve. “You need to be progressive,” Mackey said. “You need to be lean. You need to listen to the voice of customers. You need to add the technology pieces that other larger suppliers might be adding. And if you can’t add them or deploy them fully, then you need to do your best to pull out the key elements that matter to the distributor. But I do believe that you can be an independent company and be successful. But, you can’t do it and be lazy either.”

Or, you could go the route of private equity and, on paper, solve those problems, but with the possibility that things don’t go perfectly to plan. “And that’s really what it comes down to. Is it possible that without private equity those big investments [at HPG] would be made? It’s possible,” Anderson said. “But, the likelihood, at least based on my experience, is that they wouldn’t have happened. They would have continued to make do with what they had. And what that in effect means is that those with a bias toward growth, with a bias toward investing in the future, are going to increasingly separate from those who are playing not to lose.”